TransUnion D2C Evolution

If you’re looking for a direct-to-consumer business with tons of upside, it’s TransUnion’s direct business. With 2 million+ people visiting TransUnion’s homepage each quarter, there’s a window of opportunity every day to provide a stellar experience whether that person may be looking to dispute an item on their credit report, check their credit score, look for a credit card, or even protect their identity. Given the current products today are not connected together gave the UX team tons of room to work with and allowed us to re-imagine the entire ecosystem.

My role & our business goal

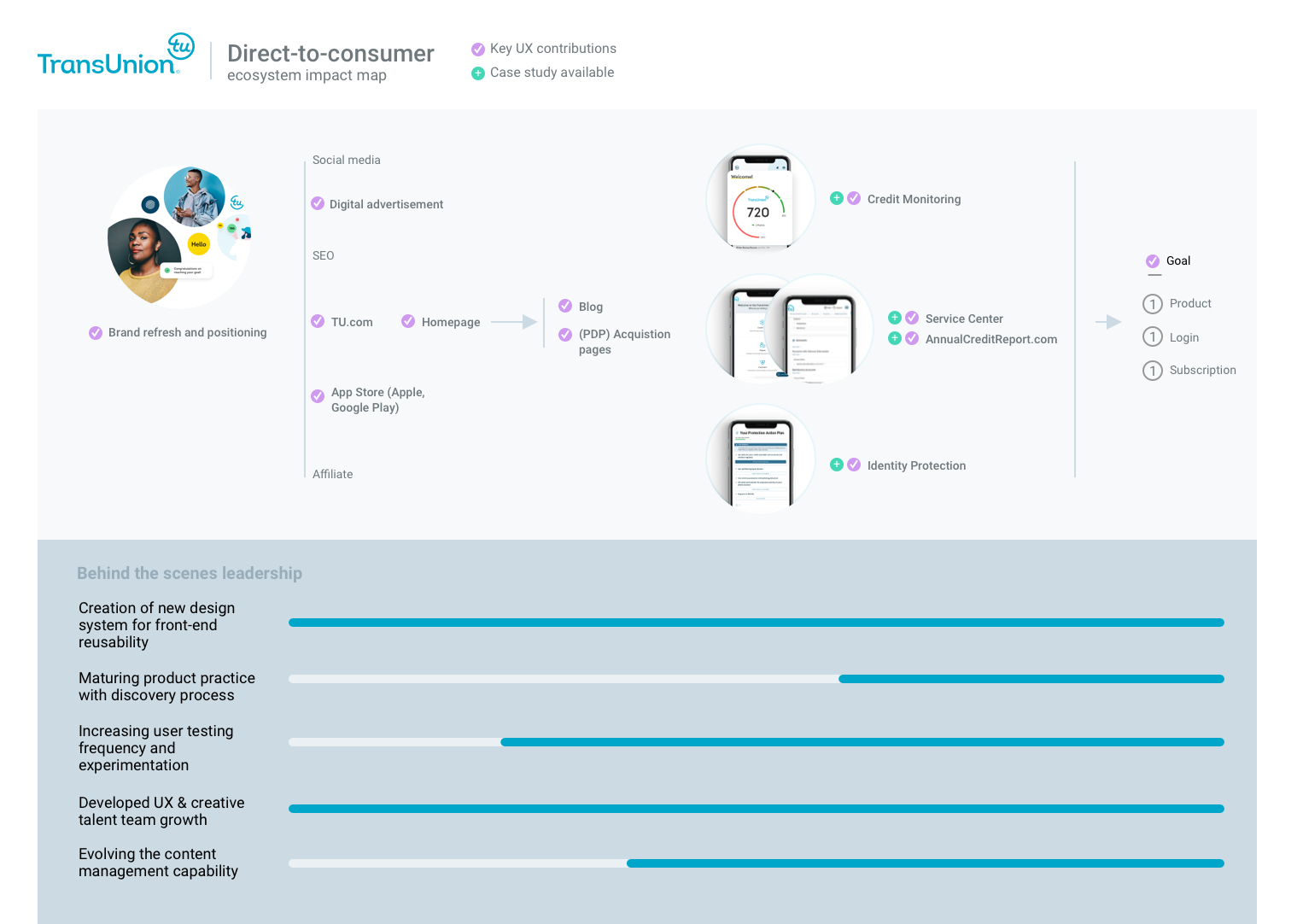

Hired in 2020 as the first head of product design at TransUnion, I was tasked to investigate the direct-to-consumer channel alongside my product counterparts and deliver a business case that outlined short- and long-term solutions backed by total addressable market and had cross-functional stakeholder buy in. Below you’ll see how we went about this along with our vision video to set the tone and key projects that delivered positive business impact.

UX impact map shows how we're chipping away at our goal

Key case studies to check out

Personalized identity protection:

Objective: Evolve our basic identity protection capabilities to help consumers truly understand what actions they should take to protect themselves from fraud and identity theft.

TransUnion’s credit monitoring app redesign

Objective: Modernize the flagship mobile app UX and value prop by leveraging the evolved brand aesthetics, creating a reusable component library system, addressing key ADA / usability issues and developing a competitive premium credit monitoring offer.

Improve consumers borrowing risk:

Objective: Educate consumers on how they can best get prepared before applying for credit by providing them a personalized assessment based on what lenders truly look for in quality borrowers.

Reduce call volume regarding account access issues within the Service Center:

Objective: Modernize 10+ year user flows that make it hard for consumers to complete account related tasks both inside and out of the product such as; reset a password, retrieve a username, verify a device, or get an answer on their own without having to pick up a phone.

Annual credit report redesign:

Objective: Modernize a federal required free credit report product so consumers can easily access their information, understand the details, and easily take action if needed.

Increase credit card conversions:

Objective: Bring personalized credit card offers to TU’s Credit Monitoring user base to grow third-party revenue and help consumers find the right card for them based on their credit profile.