Personalized identity protection

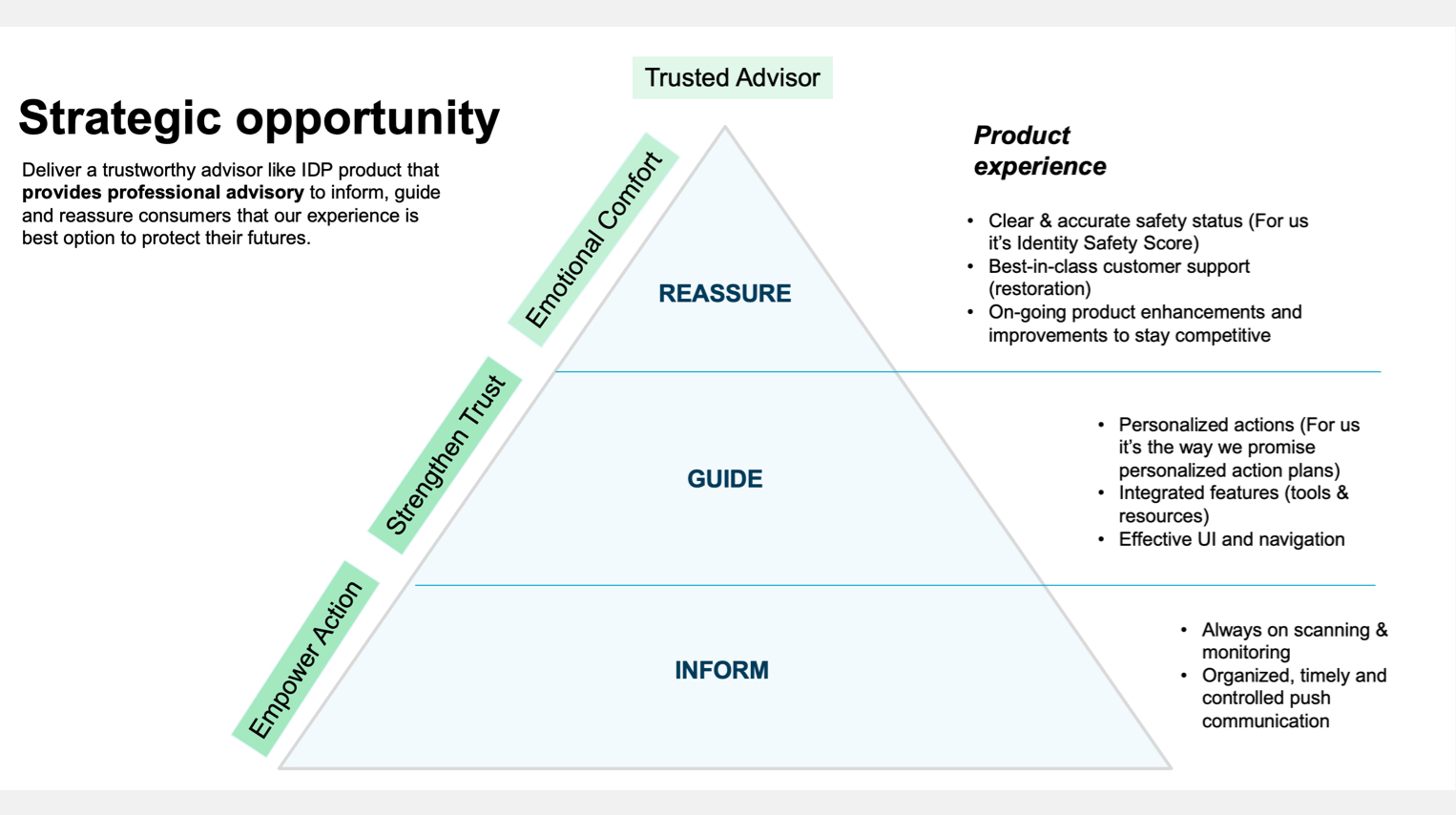

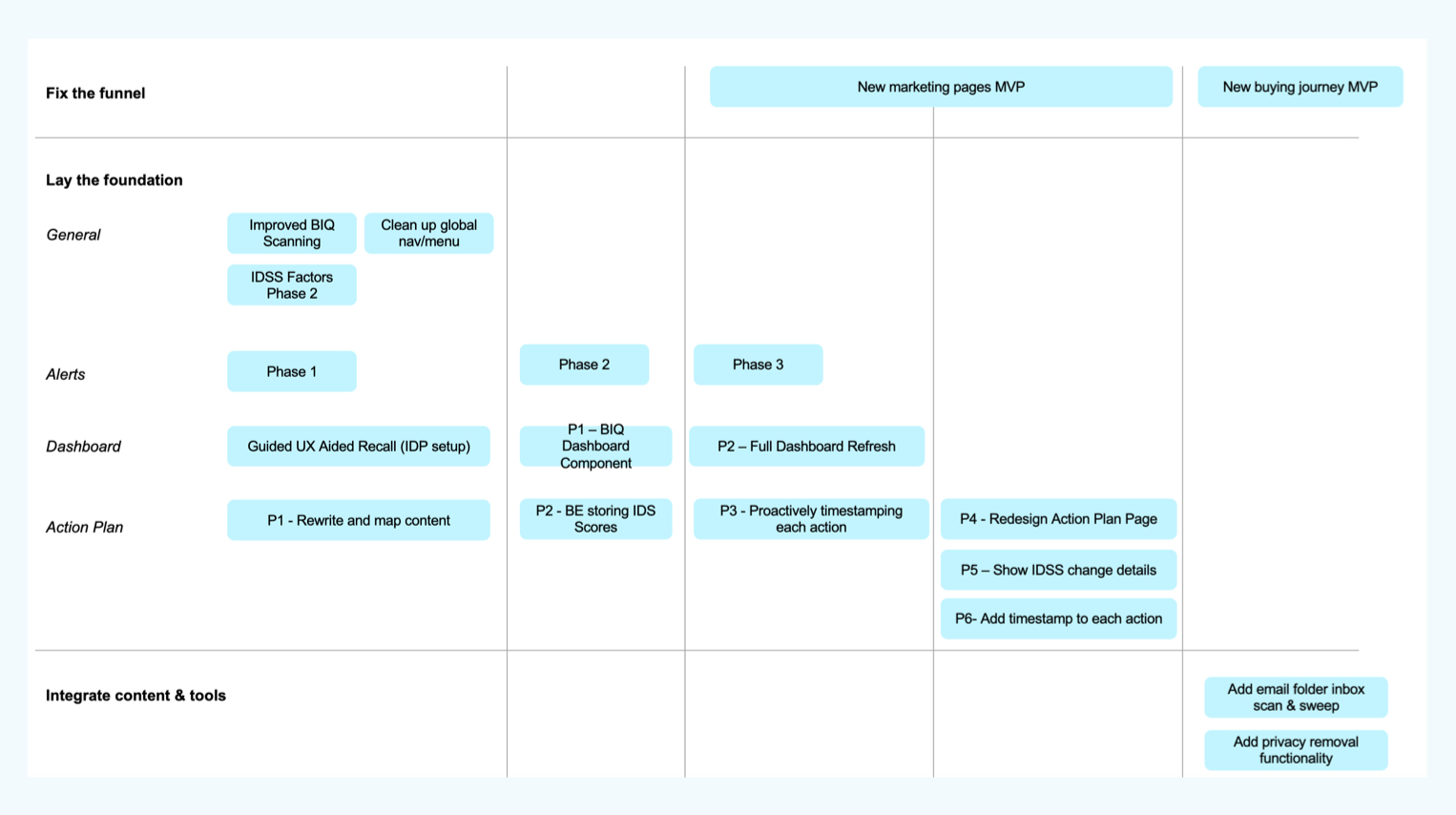

Objective: Evolve our basic identity protection capabilities to help consumers truly understand what actions they should actually take to protect themselves from fraud, identity theft, and other cyber crimes.

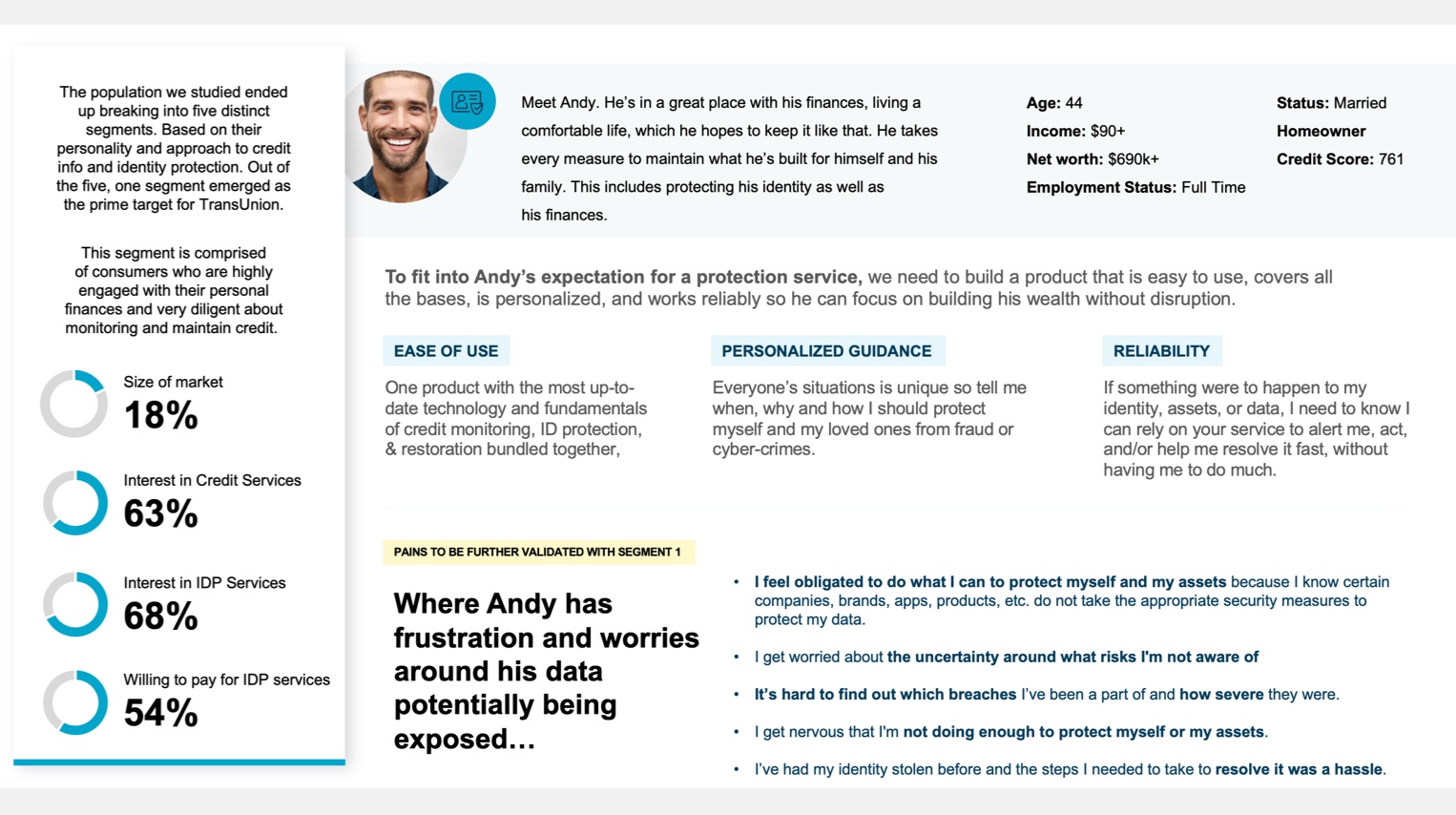

Why? According to our 2023 user research – 67% of consumers still claim they’re unaware of what actions to take when their data is exposed and are overwhelmed on where to start due to the number of alerts they get with basic recommendations.

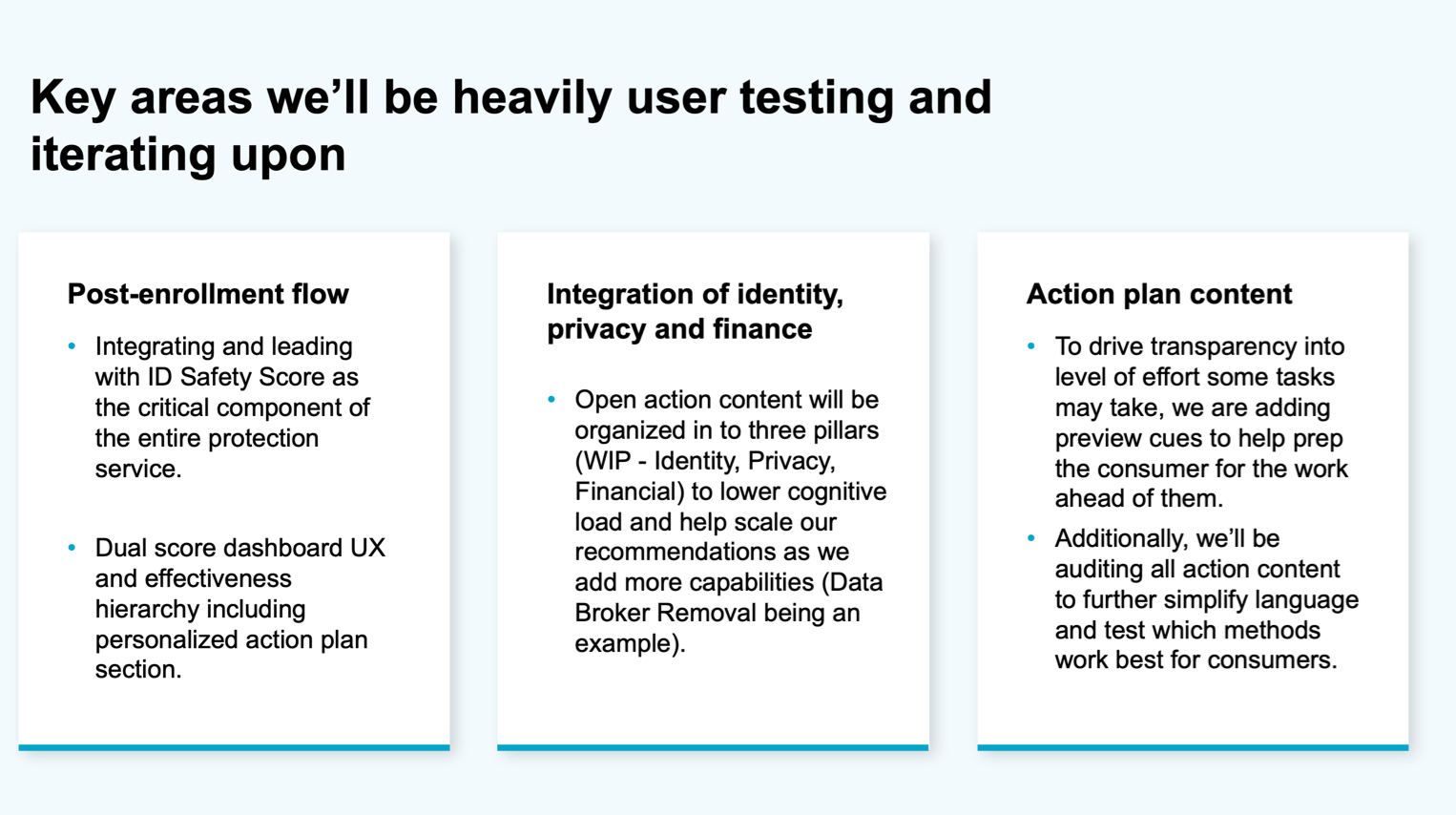

Our solution: We created a solution that provides personalized recommendations based on a consumer’s data exposure history that can guide them on how to prevent identity theft and fraud from occurring in the future. Our experience does this by tapping into our database with every publicly reported US breach protected by multiple patents making it 8X’s as powerful than typical dark web databases. Check out the video we created below to see how it works.

Driving behavior in order to build a UX that customers use habitually

Inspired by the”Hook Model“, our UX team used the “reward” angle as a way to show consumers when they take an action it’s reducing their risk which was the reason we introduced the identity safety score. As shown in the video above, you can see that each action has a level of effort along with a projected impact value which a consumer can easily preview before committing to an action. As we know, these consumers are busy and have very little time so our UX needs to be quick, automated and convenient based on their lifestyle.

A great opportunity for Financial Institutions

According to our research, 56% of consumers are worried that their banks are not doing enough to protect their PII and those banks who are offering identity protection rely on just the dark web monitoring which mainly helps detect (and not prevent) new credit fraud.

With 37% of bank consumers interested in bundling identity theft protection and data breach protection with a checking account, our solution becomes the perfect fit for banks to consider. Given these insights we see a growth opportunity to create an Indirect B2B2C solution specifically for FIs within our TruEmpower product.

We recently presented our solution at Finovate Spring 2024. Check out our demo below.

[1]TransUnion Consumer pulse survey, Q1 2023, n=2.2826

[2]TransUnion User Research Identity Force Consumer Diary Study, Q2,2023

[3]Javelin, 2022 Identity Fraud Study

[4]Data sources include DoJ, Federal Trade Commission, Bureau of Labor Statistics, and other 3rd party industry research providers

[5]Source: Cornerstone Advisors