Improve consumers borrowing risk

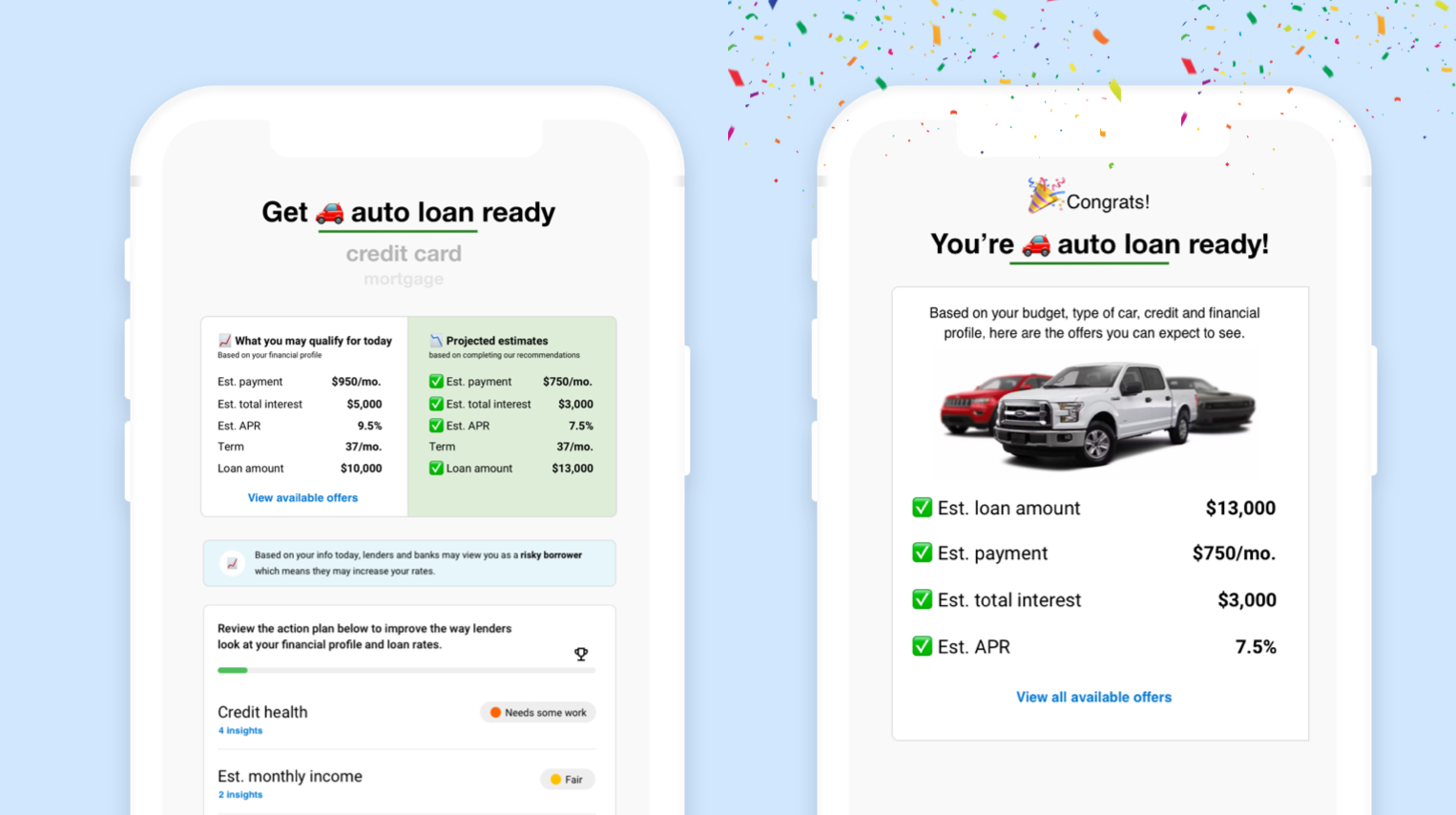

Objective: Educate consumers on how they can best get prepared before applying for credit by providing them a personalized assessment based on what lenders truly look for in quality borrowers.

Background: With financial inclusion being one of TransUnion’s main priorities, we were on a mission to bring to life a way to get consumers a solution that could quickly get them as best prepared as we could before they applied for credit. Doing this would do two things for TransUnion; 1) We help consumers improve their overall credit health 2) We are able to get new financial data that we’ve never had access to such as verified income, utilities, rent, and more. 3) We can suggest personalized offers directly to consumers who now have great approval odds.

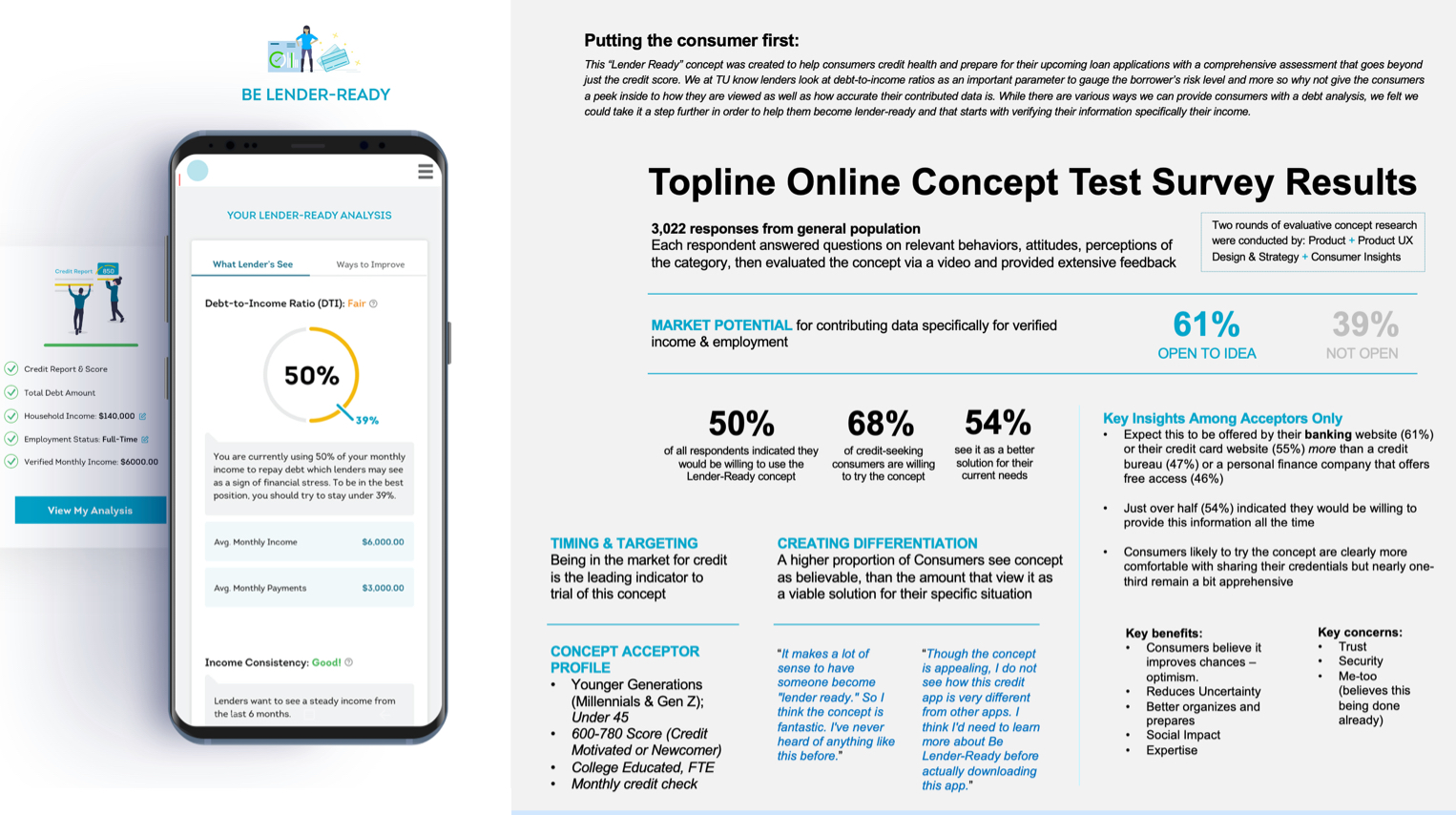

Building confidence with our concept before committing to a build

According to our market concept research, we saw 61% of consumers show interest in leveraging a feature like this especially among up-and-coming credit seekers.

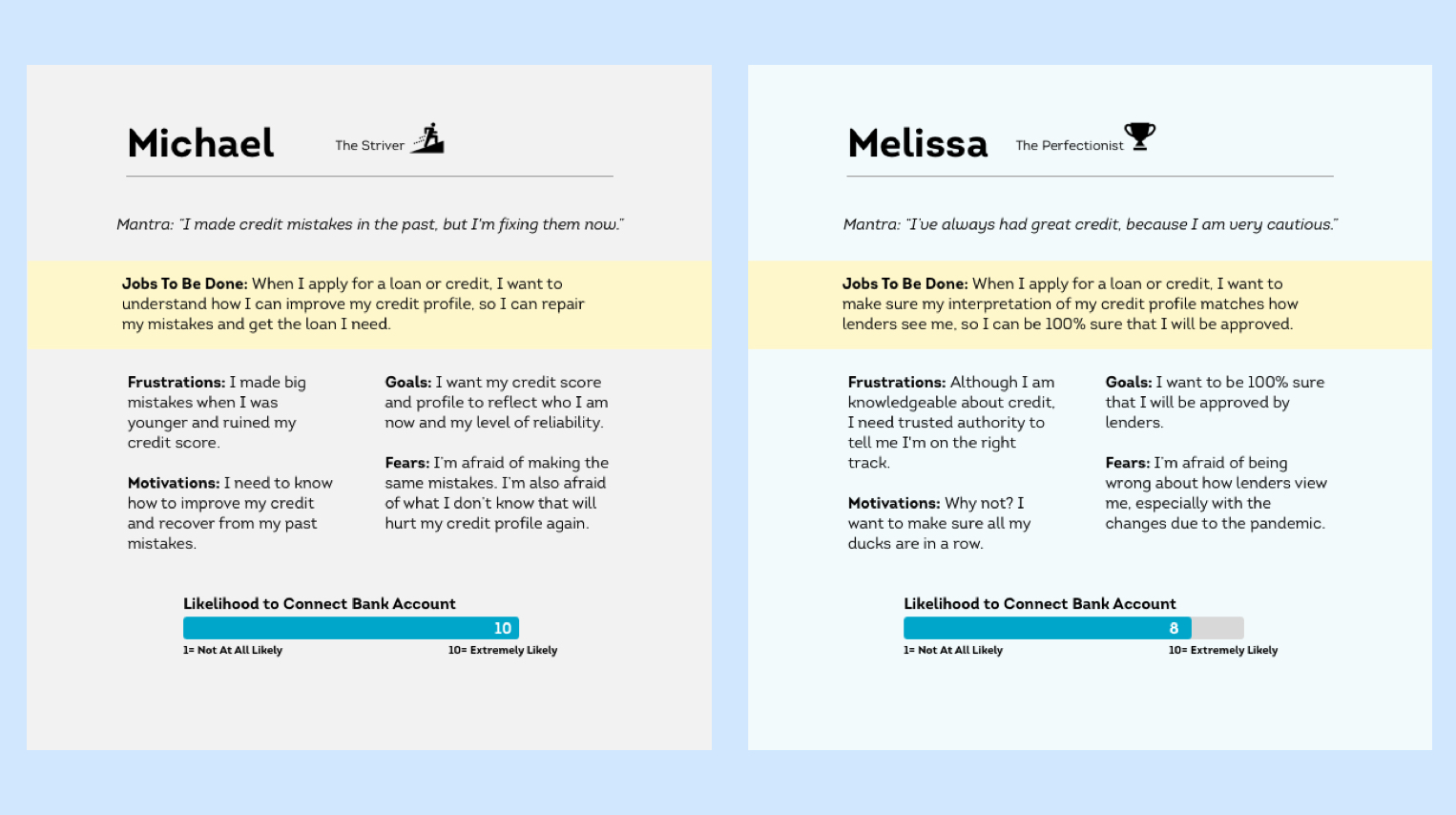

Target consumer profile groups

We also crafted two ideal consumer profiles for who we believe would be using this experience according to our in-depth user interviews. Understanding these two groups ultimately helped us design the final experience (video below) and tailor content to fit their emotional state and financial situation.