TransUnion D2C Evolution

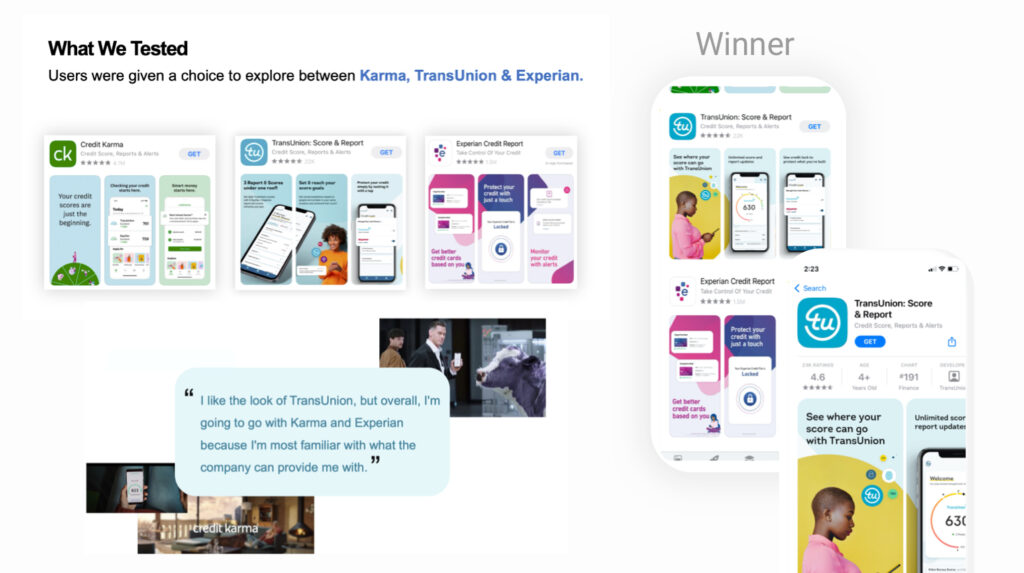

As Head of UX at TransUnion, my team and I led the strategic evolution of our digital consumer experience, transforming how tens of millions of users engage with our credit and identity solutions across web and mobile platforms. Under my leadership, I spearheaded the redesign of TransUnion’s core digital ecosystem, aligning it with modern consumer expectations and business goals through a human-centered design approach.

One of our most impactful achievements was the successful redesign and relaunch of TransUnion’s credit monitoring freemium and premium offerings. This new experience delivers a highly engaging credit education solution integrated with enhanced premium monitoring services.

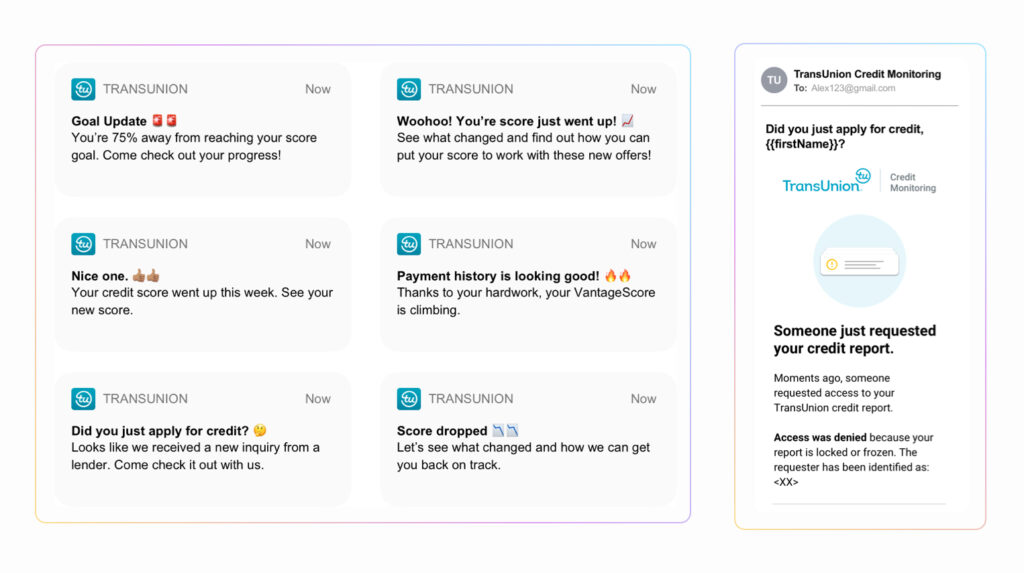

Consumers now have access to a unified experience where they can get daily TransUnion credit scores and reports, free credit education tools and can easily access our free regulatory services like dispute and credit freeze. A key piece of our business model was the creation of a network of third-party financial offers, tailored to individual goals and credit profiles to help drive additional revenue.

This offering is expected to significantly expand TransUnion’s ability to serve its digital audience, providing value to both new and existing users. The phased rollout began in early 2025 and is already showing strong engagement metrics.

Executive Buy In

The most underrated and hardest thing we did for this was “getting buy in from the top”.

To help paint this picture, we partnered with our product teams to create the business case for why this transformation was needed. Leveraging omni-channel consumer trends, feedback, and in-product behavior, we were able to articulate our vision through the video below.

And now, our vision is here.

✅ Reduced consumer support calls related to credit education and login issues.

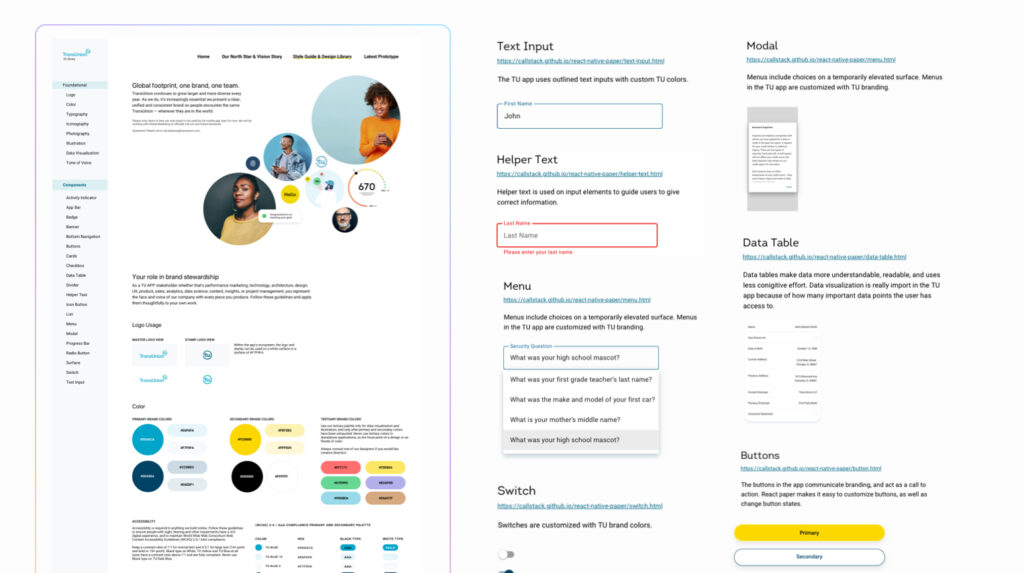

✅ Established a TransUnion design system that unified brand expression and reusable components across platforms.

✅ Consistent Web & App experience and capabilities.

✅ Implemented data-informed design practices to optimize conversion and engagement.

✅ Elevated (ADA) accessibility and inclusivity standards across all digital touch-points.

These efforts have positioned TransUnion as a leader in consumer-centric financial experiences, with measurable improvements in user satisfaction, retention, and business performance.

Consistent branding and UI across all channels

Additional Key Contributions to TransUnion's D2C Business

Personalized identity protection:

Objective: Evolve our basic identity protection capabilities to help consumers truly understand what actions they should take to protect themselves from fraud and identity theft.

Reducing support cost with a revamped experience.

Objective: Modernize 10+ year user flows that make it hard for consumers to complete account related tasks both inside and out of the product such as; reset a password, retrieve a username, verify a device, or get an answer on their own without having to pick up a phone.

Improve consumers borrowing risk:

Objective: Educate consumers on how they can best get prepared before applying for credit by providing them a personalized assessment based on what lenders truly look for in quality borrowers.

Annual credit report redesign:

Objective: Modernize a federal required free credit report product so consumers can easily access their information, understand the details, and easily take action if needed.